Verimatic characteristics of people who are easily made by financial institutions 6 | Asset Defense Media for the wealthy | Gentosha Gold Online

Why are small businesses easy to be forced to go out of business?As we rush, the cause is only one of the lack of funds.It is the practice and timing of loans that hold the key to continuing the business for a long time.I will explain the hints for sound management that I realized from the real voices of the presidents and also realized myself as a manager.

[Related article] When borrowing money, "one word" ... Back trick that makes loans easier [tax accountant explanation]

There are more companies that are in trouble because they don't have money

It is the practice and timing of loans that hold the key to continuing business for a long time.What I noticed about this serious fact was that when I was 25, I heard many worries common to the founding president.

At that time, I was a lecturer at the qualified school "TAC".In addition, using the free time between classes, I was also working on bookkeeping for a company that had just been founded, but I was worried about loans that spilled out a lot from the president's mouth.

"I started a business, but my sales didn't go well and I'm in trouble."

"I want to borrow money, but it's hard to lend to a deficit company."

Listening to these messed up stories and looking at the books of the company, the reasons such as "Why do you lose money in the company" and "when do you need money?"I also saw it.

The reality is that "after you have trouble with money"

For example, a company with strong sales will create a sarcastic situation in which payments such as purchasing are late, and the more money you have, the less your funded funds will be.A contracting company in the construction industry is a typical example, but if the deposit is originally postponed due to delays in construction, etc., it will quickly be driven into dying.

Seasonal fluctuations also increase the risk of short funding shorts in the month when sales fall.In the moving business, etc., sales will drop by more than twice as much as usual in February to April, but in November, sales will drop sharply.In the banquet season, even if sales increase in the banquet season, the number of part -time jobs will increase accordingly, so that labor costs will increase, so you may be driven into a severe state in the next month.

Nevertheless, it would be nice if sales and profits continue to rise, but financial institutions do not easily make a loan for companies that have no transactions and have unstable management.

In addition, businesses assuming multiple stores, such as restaurants, require a sense of speed to immediately pay the property by immediately paying the deposit when finding a tenant with good conditions.However, unless you have a good performance, you can get a loan immediately when you want to borrow.Because of the lack of funds, there are many cases where you can give up your chance to open a store.

He faced the real president's voice and the numbers on the bookkeeping, and noticed that "if there is no funding power, it will not go to business" and "it is important to store surplus before you are in trouble."

When you are not in trouble, "when borrowing" of money

What I myself start up a company and become president is that it is important to always act with a hypothesis.Of course, even if nobody is independent because of "failure", it is also important to have a negative idea of "if it would not work better than expected" along with positive.

If you are a business, it is OK if you do it, but if you hire an employee, it is also important to take a risk -based measure that "if this sales are gone, there will be people who are lost on the street."

New development is not as easy as "you should do business when it comes to an emergency."When there is nothing, in a sense, "keeping money when borrowed", in a sense, the attitude of "defense" means something in the unlikely event.

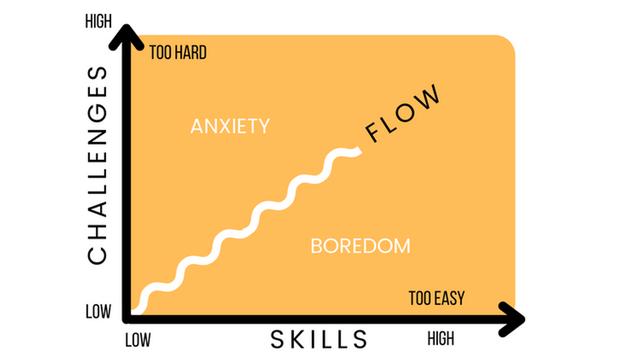

I think this composition is similar to the idea of preventive medicine."I have never caught a cold before," and if you go to the hospital after your physical condition is sick, you will be more risky.Instead, it is important to have regular medical examinations when you do not feel any problems, and to work early on your life according to the case.In other words, as a precautionary preventive treatment leads to physical health, borrowing early in anticipation of the lack of funds in business can lead to health management.

Characteristics of people who are easily made by financial institutions as "loan NG"

My company, which supports loans, will receive more than 1,000 inquiries a month, but about 20 % of the cases will be held through telephone or email and actually meet.。To be honest, no matter how much money you want to borrow, there are many cases where you have to judge that it is difficult to make a loan at this stage.

In particular, those who are likely to be NG are those who apply to the following items.It doesn't mean that even if you apply one, it will always fail, but it is not better to clear it with planning.First, check as a guide to "whether you can borrow or not."

1.Credit black person]

Within the last 5 to seven years, credit accidents, that is, delays in repayments, or stepping down, are less likely to get a loan.

[2.Those who have no tax or delinquent]

If there is an unpaid tax or delinquent, such as income tax, resident tax, business tax, and consumption tax, the possibility of loan will be reduced.Before you get a loan, pay for unpaid or delinquent.

[3.Utility costs, delays in rent payment]

When you get a loan, you will always be checked for a half -year personal passbook.If you pay at a convenience store in cash, you may be required to submit a three -month receipt.

[4.Those who do not have their own funds or have opaque of their own funds]

Even if you have money in your account, the so -called showing money, such as "the money is being transferred in a lump from others," "the passbook is suddenly increasing," and "the capital is being withdrawn immediately after the company has been established."〟Let's know that there are high cases that are not recognized as self -funds.

[5.People who borrow money from financial institutions and have a lot of repayments]

If you use consumer finance and credit loans, your evaluation will be reduced.Financial institutions will contact you for credit information in a company that manages and discloses credit information called CIC (CIC) during the loan screening.Be careful as you lie, as your heart will be even worse.

[6.People who have not kept the payment date]

It is important to note that the delay in the mobile phone fee will also be posted on the CIC information.

【図表】 当てはまると融資のハードルは高い!? 6つのチェックリスト

Koichi Tahara

CEO Solabo Co., Ltd.