What kind of company is Sprint acquired by Softbank--Junya Suzuki's view

As previously reported, Softbank announced on the 15th that it has agreed to acquire Sprint Nextel for $ 20.1 billion. Of this amount, $ 12.1 billion will be paid to Sprint's existing shareholders, and the remaining $ 8 billion will be invested directly in Sprint itself to strengthen the company's financial position in the future. As a whole, SoftBank will acquire about 70% of Sprint shares, and the remaining 30% will be for acquisition by other shareholders, including general investors.

Currently listed on the New York Stock Exchange (NYSE), Sprint will continue to be listed and enjoy the benefits of continuing to operate locally as a US company. In this article, we will first consider "What kind of company is Sprint?" And "Advantages / disadvantages of acquisitions for existing Japanese users" that Japanese readers first wonder.

What kind of company is Sprint?

Mr. Masayoshi Son (left), President of Softbank, and Mr. Dan Hesse (right), Sprint CEO of the United States.They say they've known Hesse since he left AT & T (when he was a long-distance telephone company) and ran a venture company.

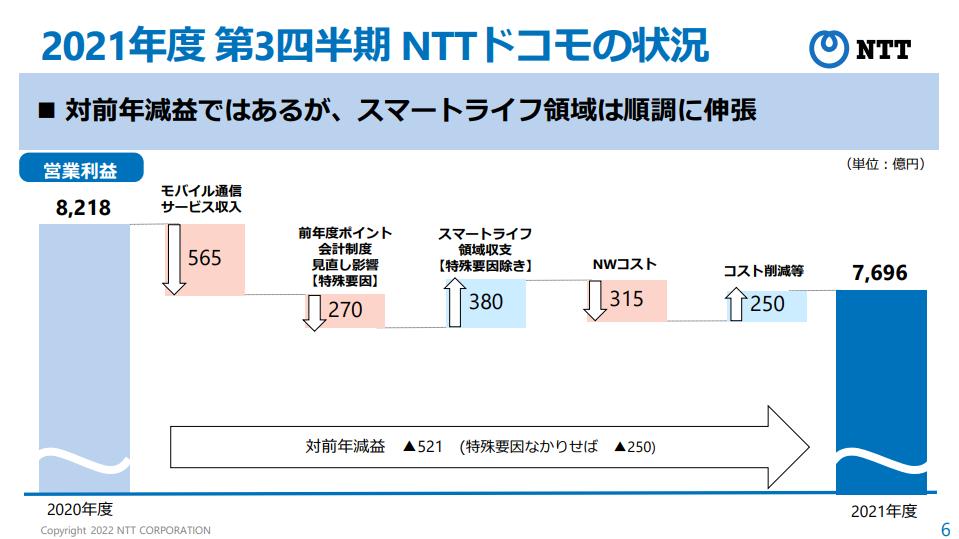

Virtually only three major companies (NTT DoCoMo, KDDI, Softbank) exist as Tier 1 providers, and the rest are MVNOs, compared to Japan, where the US mobile phone market is confused with carriers of various sizes, large, medium and small, and has a wide variety. On the other hand, most of the contract share is biased toward major companies, for example, top Verizon Wireless has a share of 111 million and a share of 32%, second place AT & T has a share of 105 million and a share of 30%, and third place Sprint-Nextel. Is 56 million, with a 16% share, followed by carriers with a 10% or less share, such as T-Mobile USA, MetroPCS, and Cricket Wireless (Leap Wireless).

The two major companies alone have a market share of more than 60% and are in an oligopolistic state. Another characteristic of the US market is that many carriers are adopting CDMA technology for 3G networks. For example, with the exception of AT & T in 2nd place and T-Mobile in 4th place, almost all are CDMA carriers. The top carriers are mainly postpaid contracts, while the bottom carriers are mainly prepaid, and are gaining popularity at low prices, especially among young people and low-income earners. Around this time, the characteristics unique to the United States, where the wealthy class and the other classes are clearly separated, have emerged.

Postpaid, that is, there are many fixed-term contract users, which is also a feature in the United States. In Japan, where prepaid contracts were excluded from crime countermeasures for a while, there are many postpaid contracts at a rate close to 100%, but the United States also has a high ratio of postpaid contracts. However, it should be noted that only the top four companies have a high postpaid ratio, and the remaining medium-sized and smaller carriers are often prepaid-only carriers, and the ratio is close to 30%. Sprint is the largest MVNO operator in the United States, and many of these MVNO operators are developing prepaid services. The number of Sprint contracts includes the number of contracts with this MVNO, that is, about 30% of the total number of Sprint contracts is due to prepaid contracts (the figure is Softbank's material at the press conference).

Inter-career competition that has begun to change with the advent of the smartphone era

In 2002, when I just arrived in the United States, Sprint was the first carrier I contracted for a local life. Monthly maintenance costs are lower than those of the top carriers at the time, and there is also the fact that Sprint was the only carrier that I could sign up for, especially if I had just arrived in the United States and had no Social Security Number (SSN) or credit history. At that time, mobile carriers were still in the top ranks, such as Verizon Wireless, Cingular (currently AT & T), Sprint, and AT & T Wireless (later acquired by Cingular). It was in competition. It was an era when each of them had their own unique characteristics and worked hard.

10 RV GIVE-AWAY starts now .. must use #RVdotCOM and tell me what you want to learn about the RV lifestyle ....… https://t.co/k8Jbu1HfnO

— Marcus Lemonis Fri Jan 08 12:20:10 +0000 2021

The antagonism began to collapse after the acquisition of the same trader widened the gap in the number of contracts between carriers and the arrival of the boom in smartphones such as the iPhone. In 2004, Cingular acquired AT & T Wireless, the mobile phone division of AT & T, the then long-distance carrier, significantly increasing the total number of contracts. At that time, Verizon Wireless had already begun to separate the number of contracts from its rivals as the largest, but this caused the phenomenon that the number of Cingular contracts temporarily overtook Verizon Wireless. However, the momentum of Verizon Wireless at that time was strong, and it was only a matter of time before the two companies turned around again.

A long time ago, Cingular was a mobile phone carrier that was born as a joint venture between SBC Communications and BellSouth, a baby bell (a telecommunications operator that split AT & T's regional telecommunications business), but SBC acquired AT & T, a long-distance phone. By changing the company name to AT & T and absorbing BellSouth, it succeeded in making Cingular a wholly owned subsidiary, and unified Cingular into the AT & T brand as "AT & T Mobility." The first move the old Cingular, which became the new AT & T, took is to sell the iPhone under an exclusive contract with Apple.

At the time, Apple allegedly had negotiations with Verizon Wireless, the industry leader in selling the iPhone, but I've heard that the deal wasn't met between the two companies. It was AT & T that ultimately won the iPhone sales exclusivity in the United States, and many know the breakthroughs that followed. The author thinks that the iPhone is a big factor in the fact that AT & T, which was once far apart, has caught up with Verizon and has come to the point of competing.

Currently, Sprint is in third place with a 16% share of the US mobile phone market. Although it is ranked 3rd, it is characterized by the fact that only two major companies, Verizon Wireless and AT & T, have an oligopoly of more than 60% (the figure is Softbank's material at the press conference).

Operating costs are high in the United States, which has a large land area.

Contrary to Verizon Wireless, which is steadily increasing the number of subscribers with a stable network, and AT & T, which has greatly increased the number of subscribers with attractive terminals such as the iPhone, the situation of carriers below the third place was not good. The United States has a large land area, and even if it is centered on an urban area, it has a large area to cover. The burden of frequency acquisition costs, equipment costs, operating costs, etc. is heavy, and the kitchen situation of medium-sized and smaller carriers with a small number of contracts has been particularly troubled.

As a result, more users have gathered at major companies, and the situation where subscribers of medium-sized and smaller companies have remained flat or decreased has become noticeable. In particular, Sprint's impatience, while the gap with the top two companies seems to have been great, acquired Nextel Communications, which was the fifth largest in the industry at the time of 2005, and made a leap to a scale approaching the top two companies in terms of the number of subscribers. ..

However, for CDMA Sprint, Nextel is developing a service using a unique communication technology called iDEN, and the network was not compatible. It has been pointed out from the time of the announcement of the acquisition that "the merger of the two companies cannot be expected to have a synergistic effect," and in fact, the result was that it led to a gradual outflow rather than maintaining the number of subscribers.

The merged company Sprint-Nextel has already announced the suspension of the iDEN service, and it is expected to be suspended in the middle of 2013. The transition to Sprint's CDMA network is already underway, including Boost Mobile, which was Nextel's prepaid division.

Mobile phone penetration in the United States. It seems that it is growing steadily, but in reality it has already exceeded the population penetration rate of 100% and is saturated. The current growth is aimed at the demand for the second unit (the figure is Softbank's material at the press conference)

Investment burden weights and LTE services

Sprint has posted a continuous deficit due to the heavy burden of capital investment, but another cause of straying is the development of 4G networks. The company originally developed WiMAX services under the "Xohm" brand with a view to providing mobile broadband, and was competing with Clearwire, which was also developing WiMAX services nationwide. However, it was inefficient for capital investment to expand service areas nationwide separately, and the competition was often a problem.

With the help of the government, the two companies finally agreed to jointly develop the service, and announced the integration of the service networks of both companies in 2008. Instead of transferring its WiMAX equipment to Clearwire, Sprint took over the shares issued by Clearwire and became a major shareholder with nearly half of the company's shares. Clearwire has named the unified brand of WiMAX service "Clear" and Sprint has the right to use this Clear as an MVNO. The first WiMAX compatible smartphone "HTC EVO 4G" was announced as a result of this.

However, the alliance between the two companies was not smooth, and both Sprint and Clearwire remained at a standstill. With the use of Clear's WiMAX service not progressing much, it was reported that Sprint is aiming to purchase Clearwire shares further and make it a wholly owned subsidiary in the summer of 2011.

Due to the above-mentioned circumstances, Sprint holds about 50% of Clearwire shares (Editor's note: October 19, it was reported that the majority will be acquired), while Clearwire itself is 30%, the rest is Intel and Companies such as Google and CATV had a shareholder composition that companies that invested in Clearwire in the early days had.

There were some companies that left the company later, and although there were some changes in the shareholding ratio, there was no change in the situation where Sprint was 50% and Clearwire was the rest. It seems that Sprint was expected to take control of the company by purchasing the remaining shares with the cooperation of shareholders other than Clearwire. There are many unclear points about the aim, but it seems that the first thing to do was to acquire the frequency assets of Clearwire itself, and to use it as the foundation for network development centered on LTE.