If you cannot find a "deposit passbook / card" after the death of the heir [Inheritance professional explanation]

If you cannot find a "deposit passbook / card" after the death of the heir [Inheritance professional explanation]

"Inheritance" that can happen to anyone.Be prepared in case of things and learn your knowledge on a daily basis.In this article, IBIC Co., Ltd., an inheritance consulting corporation, will explain the basic knowledge of inheritance.

[Related article] Mobile phone, credit card ... Is there an obligation to pay for the dues and delay money incurred after the parent's death? [Lawyer explains]

Cancellation of deposits and deposits / name change (1): Understanding the deposits and savings of the heir

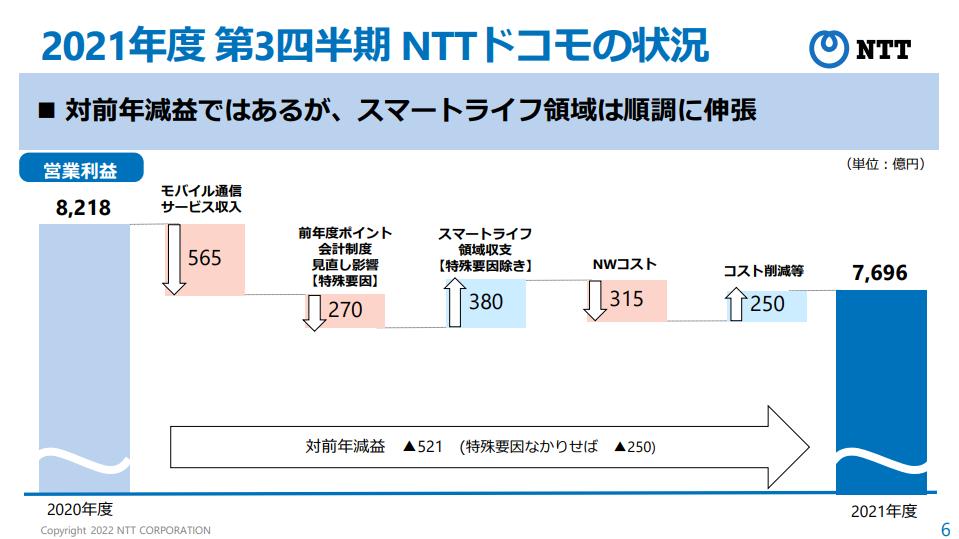

[Chart] Example of list

Let's list the passbooks and cards, notices from banks and securities companies.If you can understand the banks, branches, account numbers, etc. of deposits and deposits, proceed to (2).* If the deposit balance is not frozen and can be booked, let's book.* If you do not know if there are all passbooks or cards, or if you have one bank deposit book, there may be other accounts, so proceed to (2).

Cancellation of deposits and savings / change name (2): Go to the bank window

First, request a balance certificate at the bank window where you have a passbook / card (as of the day of death).Even if you have an account of multiple branches at the same bank, you can be issued at one branch.If the account has not been frozen yet, the bank confirmed the fact that the heirs died, and the account will always be frozen at this point.When requesting a balance certificate at the bank window, ask them to do a name.If you make a name, you can grasp the other accounts of the heirs that the heirs do not know, and the presence or absence of a lending box can be grasped, and the negative property such as loan, etc. can be understood, so transactions more than described.You can confirm that there is no.This will prevent the leakage of the procedure, which allows the heirs and tax offices to confirm accurately.

Why do you need to claim a balance certificate

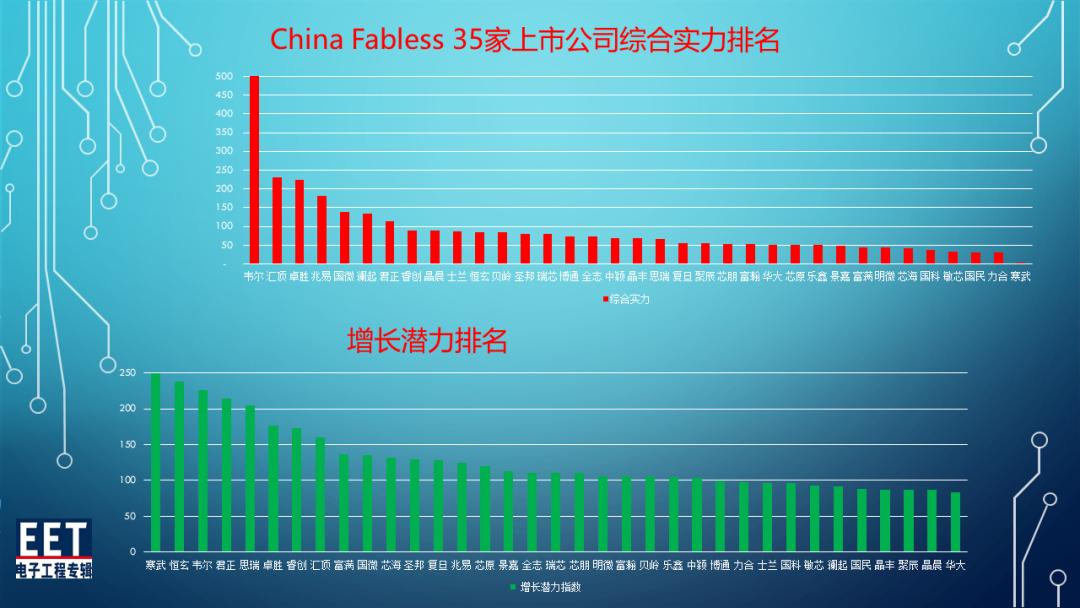

[Chart 2] Documents required for claiming a balance certificate

What a balance certificate is required for inheritance procedures is "when an inheritance tax declaration is needed", "when the passbook is lost and checking the deposit", or the material for confirming the amount of inheritance property in the inheritance.When you do. "The balance certificate is a document that describes the balance of the heir's account in the financial institution of the day when inheritance occurred.If you have a passbook, you will know the balance, but when you file an inheritance tax, you must obtain a balance certificate to make it a basis.Financial institutions can get the transaction history of each passbook in the past.If a specific heir lives with the heir, if you are going to draw a deposit and savings without permission, or if you need to file an inheritance tax, check the status of gifts in the past few years.There are times when it is convenient to get a history.The documents required to request a transaction history are the same as the attached documents of the balance certificate in [Chart 2].◆ If you cannot find a passbook or card, you can go around the bank you know, with (1) (2) of the documents required for claiming a balance certificate.For example, a branch of a bank near the heir's house or a bank branch near a place where you often go out.Even if there is an account in a different branch of the bank, most banks can be referred to by the terminal for savings and deposits within the way (there are some financial institutions that cannot be done).

次ページは:相続人が、各々離れたところに住んでいる場合の注意点最終更新:幻冬舎ゴールドオンライン