What happens to the tax if you win the lottery and the ten thousand horse coupons? (financial sector)-Yahoo! Journalism

Send

56コメント56件What happens to the tax if you win the lottery and the ten thousand horse coupons?

Win a large sum of money with a lottery ticket or horse ticket. A dream like that could happen in reality. However, in the real world, the problem of taxation follows. This time, the tax on lottery tickets and horse coupons will be explained in detail with specific examples.

Tax on lottery tickets

Lottery refers to the huge lottery tickets sold by local governments, scratched lottery tickets covered with coins to display the results, and digital choice lottery tickets. If you win the prize in these lottery tickets, you won't have to pay tax. In accordance with Article 13 of the "Lottery payment Certificate Law", it is indicated that the prize is not charged. This is because when buying lottery tickets, about 40% of the purchase amount is paid as local government residence tax. Similarly, no tax is levied on the refund of the Sports Revitalization Lottery (Article 16 of the relevant laws on the implementation of Sports Revitalization Voting, etc.). However, if these elected funds are given or inherited, gift tax and estate tax will be generated. In addition, it is illegal to buy foreign lottery and sports lottery tickets.

Tax on horse coupons

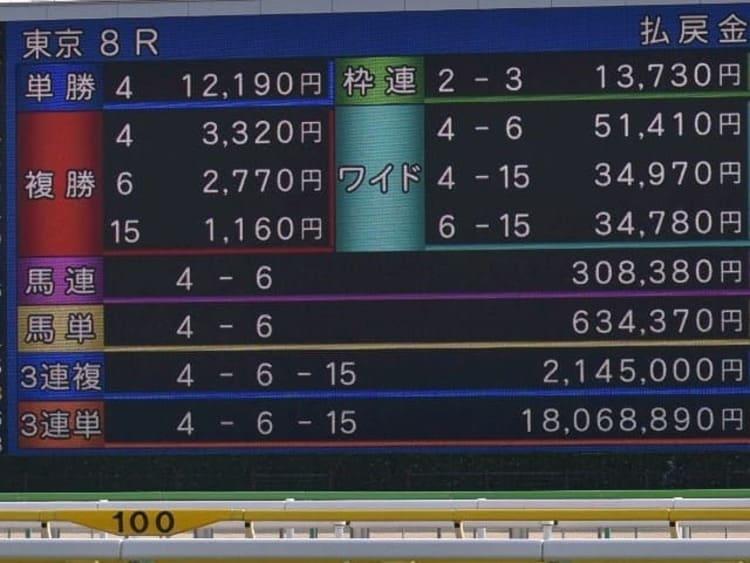

The refund of horse coupons is subject to tax. According to the purchase form of horse coupons, it can be divided into "temporary income" or "miscellaneous income". In the case of the general purchase form of horse coupons, such as buying horse coupons at the weekend, the profits obtained from horse coupons are classified as temporary income. Temporary income is allowed to be deducted to 500000 yen, and there is no need to declare if it does not exceed 500000 yen. The amount of temporary income is calculated as "(total income-the amount spent to obtain income-500000 yen) x 1/2". For example, buy a horse coupon of 100000 yen and get a refund of 1 million yen. In this case, (1 million yen-100000 yen (the purchase amount of horse coupons)-500000 yen (deduction of gold) × 1 debit 2 = 200000 yen is the amount declared as income. On the basis of this amount, together with other income, income tax and residential tax are determined. In addition, in the temporary income, the loss of horse coupons, transportation expenses, communication expenses as funds is not allowed. Therefore, in the previous example, even if the amount of money spent before the hit of the horse coupon, the taxable income of 200000 yen has not changed. On the other hand, if you have purchased horse coupons for many years as part of asset management, the profits from horse coupons are classified as miscellaneous income. Miscellaneous income needs to be declared from more than 200000 yen. The taxable income of miscellaneous income is calculated as "total income amount-required funds". For example, if you buy 1 billion yen horse coupons a year, you will get a refund of 2 billion yen. In this case, 2 billion yen-1 billion (including the total purchase amount of horse coupons, including the loss of horse coupons) = 1 billion yen of declared miscellaneous income. On the basis of this amount, together with other income, income tax and residential tax are determined. In miscellaneous income, the loss of horse coupons, transportation expenses and communication expenses are recognized as funds. Therefore, compared with temporary income, miscellaneous income can be financed by the loss of horse coupons, so taxes can be greatly reduced. However, the barriers identified as miscellaneous income are high. According to the decision of the Supreme Court and the Internal Revenue Office, considering the period, frequency and frequency of purchasing horse coupons and the scale and period of profits, it is divided into temporary income or miscellaneous income. The situation classified as miscellaneous income envisages the use of computers to buy horse coupons in large quantities, which is best considered not applicable to most people. Therefore, it is suggested that the profits from horse coupons should be regarded as temporary income. In addition, the above taxes are common not only in horse racing, but also in public races such as car racing, cycling and cycling.

If you have any difficulties, discuss with me.

As mentioned above, lottery tickets are tax-free and horse coupons are taxed. In particular, the judgment of temporary income or miscellaneous income is a special topic. If there are difficulties, please consult experts such as tax agents. In addition, the number of people who buy horse coupons online is on the increase recently. Because these have left their resumes, there is an inspection by the Inland Revenue Bureau. If there is a profit, it must be calculated and declared. Tax writer on the refund of horse racing in the National tax Office of the Lottery: FINANCIAL FIELD editorial Supervisor: Zhimi Ninai CFP (R) approver, first-tier financial plan second-tier technician (asset use) DC (determined fund-raising pension) planner, mortgage consultant, securities clerk

Financial field editing section

最終更新:ファイナンシャルフィールド

![[Excel] How to paste images such as photos and diagrams [Excel] How to paste images such as photos and diagrams](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/72539ecbf7413c05e4465b39ca06e8e0_0.jpeg)