Yahoo! News Intel accelerates the development of manufacturing technology "Intel 18A", in-house product manufacturing and foundry service create synergistic effect

delivery

4 comments 4Photo: Impress Watch

If you've found a great #domain, but it's already registered, then you'll want to reach out to the owner to see if… https://t.co/h7H5cP1Ygh

— MarkUpgrade Thu Jun 03 15:57:15 +0000 2021

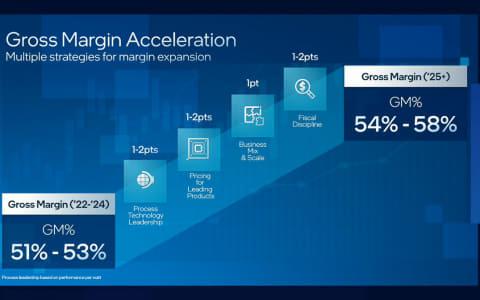

An investor briefing session "Intel Investor Meeting 2022" was held on February 17 (local time, early morning of February 18, Japan time) to explain the company's new roadmap. [See another image about this article] As reported in another article about the roadmap update of the company's main product CPU, Intel announced last year's new strategy IDM 2.0 (more advanced integrated semiconductor) We also updated the manufacturing model) and revealed that the next-generation manufacturing technology "Intel 18A" that adopted Ribbon FET and Power Via was introduced earlier than the conventional 2025 to the latter half of 2024. In this article, I would like to explain the aim of Intel's strategy on the manufacturing technology-related topics that Intel announced at the Intel Investor Meeting 2022. ■ Intel's gross profit margin drops to the low 50% range, accelerating growth strategy aiming for the 60% range again At this briefing session for investors, securities analysts were quite enthusiastic about the gross margin. About. In Japanese, it is translated as gross profit, but in more profane terms, it is "gross profit" (profit obtained by subtracting the cost of producing it from sales), but its gross profit margin. But it's expected to stay in the low 50% range for the next few years, said Dave Ginser, senior vice president and CFO of Intel. Earlier Intel had this gross margin of over 60%, which was a symbol of Intel's financial health. The slide presented by Ginzer now predicts that the range will be 51-53% between 2022 and 2024, and 54-58% after 2025. Of course, even if it is in the 50% range, it is quite excellent as a manufacturing industry, but it cannot be denied that it is no longer as good as the former "excellent" (super excellent). The fact that we dared to make predictions in such a situation can be taken as Intel's management thinking that the last few years are "time to invest." In the last few years, we have made various investments including fabs (semiconductor manufacturing factories), and the gross profit margin will rise again after 2025, when it is thought that it will get on track, that is the scenario that Intel's management envisions. That would be the case. So what's the growth strategy that comes with Intel's investment? Pat Gelsinger, the company's CEO who returned to Intel last year, said, "We can maintain our strengths and become a leader in new growth markets. It's important, "he said, while maintaining the current strengths of Intel in the business of CPUs for client PCs and CPUs for data centers, while maintaining strengths in markets where Intel has not been able to demonstrate its strengths. He explained that it is important to provide such products and services. According to Gersinger, the PC is more important than before due to the Korona-ka, but the PC market, which is already a fairly large market, cannot be expected to grow significantly in 2021. Growth in the first half of the single digits can be expected from 2025 to 2025. The data center market is expected to grow in the high single digits from 2021 to 2023, and to grow in the mid-10s by 2026. As a product needed to maintain its strength as a PC and data center market, Gelsinger said, "We have to launch the best products in the industry. The 12th generation Core and the upcoming Sapphire Rapids will compete in that way. It has become a winning product, and we will continue to introduce powerful products in the future. " As introduced in another article, CPUs such as Meteor Lake, Arrow Lake, and Lunar Lake will be introduced one by one from 2023 for client PCs, and Sapphire Rapids will be introduced soon for data centers. He explained that he will introduce Emerald Rapids in 2023, Granite Rapids and Sierra Forest for low power consumption in 2024, and a successor product in 2025. By introducing such products in rapid succession, Intel's basic strategy is to regain the technical leadership that was being lost. ■ Growth businesses for Intel are graphics and semiconductors for automobiles However, as Mr. Gelsinger himself said, for example, although the PC market is already a very large market, its market size will suddenly double in the future. There is no such thing. Therefore, if Intel does not succeed in new growth markets while maintaining its position in the PC market and data center, which currently has a large market share, Intel will regain the gross profit margin that Intel and the market desire. Returning to the% level is a dream and a dream. In fact, Intel's last decade has been a series of attempts and failures. In other words, it was difficult to find a promising market other than PCs and data centers. But now Intel seems to have finally found its growth market and is succeeding there. This time, Gelsinger listed two markets that Intel can expect to grow in the future. One is the GPU and the other is the semiconductor for automobiles. Regarding GPU, at this year's CES, dGPU known by the development code name "Alchemist" was announced as "Intel Arc Graphics". It was announced for laptops, but will be added for desktop PCs in the second quarter and workstations in the third quarter. Furthermore, from 2023 to 2024, a next-generation product called Battlemage will be added, and after 2024, the successor Celestial will be introduced. In the Celestial generation, products that are positioned for gaming GPUs in the enthusiast segment will also be introduced. Both use a mechanism called "Intel Deep Link" in which iGPU and dGPU work together to realize functions such as encoding using both iGPU and dGPU. In addition, Ponte Vecchio, which implements 2D / 3D of up to 47 dies on a package, will be introduced for HPC (High Performance Computing) such as AI learning and scientific computing. This will compete with GPUs for data centers such as NVIDIA's A100. With the introduction of such products, GPU-related sales, which were only $ 700 million in 2021, are expected to exceed $ 1 billion in 2022 and reach $ 10 billion in 2026. Explained Gersinger. A breakout session by Raja Kodori, Senior Vice President and General Manager of AXG Business Headquarters, explained that the GPU market TAM (Total Addressable Market) in 2026 will be $ 155 billion. Therefore, it is predicted that about 6.4% of the market will be acquired by Intel. And another fast-growing market for Intel is semiconductors for the automotive, and Israel's Mobileye, which the company acquired in 2017, continues to grow rapidly, shipping 100 million units last year. And explained that it has already been adopted by 13 of the world's top 15 automakers. Mobileye's presence is growing as ADAS (advanced driver assistance systems) are rapidly being implemented in automobiles. Intel announced in December of last year (2021) that it plans to IPO (Initial Public Offering) of Mobileye. The acquisition is good, but it's becoming an exceptionally successful example of Intel's acquisitions of other companies, which weren't very useful. In addition, Intel announced at this Intel Investor Meeting 2022 that it will start providing services to produce automobile-grade semiconductors with the foundry service "IFS" (Intel Foundry Services) that the company will provide in the future. As a result, for example, Japanese automobile manufacturers can entrust Intel to produce semiconductors for North American factories. It goes without saying that the North American market is an important market for Japanese automakers, and this move will be of great interest to Japanese automakers amid calls for tight semiconductors for automobiles. ■ Investment in foundry services has had a positive effect, and the development of manufacturing technology has been accelerated due to synergistic effects. He has also made several updates to the foundry service "IFS" provided by Intel. First, prior to Intel Investor Meeting 2022, it announced that it had acquired Israeli foundry "Tower Semiconductor" on February 15. This will enable Tower Semiconductor to acquire semiconductor manufacturing facilities and know-how that it has around the world, and provide them as part of IFS in the future. For example, Tower Semiconductor owns a majority (51%) stake in TPSCo (Tower Partners Semiconductor) as a Japanese subsidiary, and has three factories in Japan derived from the former Panasonic semiconductor production plant. Tower Semiconductor is a foundry that has been outsourced to manufacture semiconductors such as analog circuits, power management, and image sensors that Intel has never manufactured before, and can be said to have a complementary relationship with IFS. At this event, Intel 16 (formerly known as 22nm FinFET manufacturing process rule) started production of fundari in 2022, and Intel, which is a manufacturing technology using EUV in the latter half of 2023. Start manufacturing using 3. In addition, it is scheduled to begin production on the Intel 18A using Ribbon FET and Power Via in the second half of 2024. The introduction of these process rules is clearly ahead of the previous schedule, and the Intel 18A was previously described as after 2025, but with this announcement it will be ready for production from the second half of 2024. It is said that the wafer of the SRAM chip of Intel 18A, which was actually test-produced by Intel, was released at this event. At the moment, it is only for Intel internal use, but Intel 4 is expected to be ready for production later this year, Intel 3 in the second half of 2011, and Intel 20A in the first half of 2012. "Five generations will appear one after another within four years," Gelsinger said, emphasizing that process rule development is accelerating. Gelsinger emphasized that this acceleration of manufacturing technology development was due to Intel's launch of IFS. "Our IDM 2.0 strategy will make it more convenient for IFS customers, and the better IFS will be, the better the manufacturing technology we will use. The traditional IDM-only approach will increase. However, it is difficult to deal with R & D investment, but with the start of IFS, cash flow has improved due to payments from customers, and it has become possible to make up for IDM's weaknesses. " Stated. In other words, starting IFS will enhance Intel's own competitiveness as a semiconductor manufacturer, and making various investments toward the realization of IFS will lead to the advance introduction of manufacturing technology. He emphasized that it has led to an impact, not only for IFS customers, but also for Intel's manufacturing facilities. In this way, IFS for the company and other companies will improve synergistically, and Intel's manufacturing technology will improve steadily, which is the heart of Gelsinger's strategy. If that and the product roadmap mentioned above fit together well, there may be a day when the former "strong Intel" will come back again. At that time, there is no doubt that the day when the above-mentioned gross profit margin exceeds 60% again will come back. Of course, what is important for that is the willingness and ability to execute this roadmap. The will and skill of Intel executives such as Gelsinger will be questioned in the next few years.

PC Watch, Kazuki Kasahara

![[Excel] How to paste images such as photos and diagrams [Excel] How to paste images such as photos and diagrams](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/72539ecbf7413c05e4465b39ca06e8e0_0.jpeg)